Research

Working Papers

The Dodd-Frank Act and Hedge Fund Operational Risk (this version - January 2026)

Semifinalist for the 2024 FMA Best Paper Award

Coauthored with Prof. William N. Goetzmann and Prof. Bing Liang

Abstract: We examine the impact of the post-Dodd-Frank change in 2011 on hedge fund disclosure. We find that new questions added to SEC’s Form ADV, post-Dodd-Frank, enhance forecasting of adverse operational events compared to pre-Dodd-Frank disclosures. Using machine learning, our analysis yields a uni-dimensional operational risk score from the public SEC data, effective in predicting liquidation events, leverage changes, and performance metrics. The score also predicts net fund flows, indicating the relevance of disclosed operational risk information to investor decisions. Over five years of the post-Dodd-Frank Act, fund flow response significantly increased following the amended Form ADV implementation.

Presentations (* indicates presentation delivered by coauthor): 2024 FMA Annual Meeting; 2024 FMA Doctoral Student Consortium; 2024 SFA Annual Meeting; 11th Annual Conference on Financial Market Regulation (CFMR 2024);* 2024 Bretton Woods Accounting and Finance Ski Conference; Florida International University Finance Seminar;* 2023 INFORMS Annual Meeting; * University of Macau (2025); Shandong University (2025);* Rensselaer Polytechnic Institute Finance Seminar (2023); University of Massachusetts Amherst (2023)

Media Coverage: Faculti; see the video now

The Value of Strategic Information Release in Fintech Lending (this version - September 2025)

Coauthored with Prof. Wenyao Hu

Previously titled “Uncovering the Hidden Profit:

How the Fintech Platform Optimizes its Profit by Strategic Information Releasing?”

Abstract: We show that the financial technology platform, Prosper, displays 40% of all loans in the first minute and charges higher fees than loans in other minutes, after controlling for loan characteristics and numerous fixed effects. Our three identification tests reveal that Prosper intentionally lists loans with higher fees first to maximize revenues. Moreover, the results are more significant for loans with a higher funding probability, such as those with small amounts, short terms, and high credit scores. We finally observe that borrowers with first-minute loans are less likely to request another loan on the site after the deliberate loan listing.

Presentations (* indicates presentation delivered by coauthor): 2024 Menard Family Initiative Entrepreneurship Research Conference (invited); 2023 SFA Annual Meeting; 2023 AFA Poster Session; 3rd Annual Boca Corporate Finance and Governance Conference (2022);* 2022 FMA Global Conference;* 2022 Chinese Finance Annual Meeting;* 2022 FMA Annual Meeting; 2022 INFORMS Annual Meeting; 2022 FMA European Conference;* 2022 China Fintech Research Conference;* 2022 Boulder Summer Conference on Consumer Financial Decision Making Poster Session

Hedge Funds and ESG Sentiment (this version - January 2026)

Solo-authored Paper

Abstract: This paper investigates whether hedge funds can capitalize on fluctuations in ESG sentiment. Using a novel dataset that captures worldwide public perceptions of ESG discussions, I construct composite and pillar-level ESG sentiment indices. I find that hedge funds actively time ESG sentiment by anticipating future sentiment shifts and exploiting short-term lags between sentiment changes and subsequent stock price adjustments to generate higher alpha and reduce downside risk. Funds’ timing skills vary across strategies, with directional and semi-directional funds exhibiting stronger average timing abilities. These results highlight that hedge funds can harness public, values-based perceptions of ESG practices to enhance performance and manage risk.

Presentations: 2025 FMA Doctoral Student Consortium; 2025 FMA New Idea Session; The Friends of Women in Finance 4th Symposium in Greater New York; 6th Annual RCF-ECGI Conference; ASFAAG American Chapter Conference 2026 (in schedule); 65th Annual Southwestern Finance Association (SWFA) Conference (in schedule); University of Massachussets Amherst; Yale University

Publication

Assessing U.S. Insurance Firms' Climate Change Impact and Response

Coauthored with Prof. Aparna Gupta and Prof. Abena Owusu (published on April 12, 2023)

Supported by 2019 Global Association of Risk Professionals (GARP) Research Fellowship

The Geneva Papers on Risk and Insurance-Issues and Practice, 49(3), 571-604, (2024)

Abstract: Climate change poses a serious risk for insurance firms, threatening their sustainability from numerous channels of impact. Assessing this impact, however, is not straightforward. We assess and distinguish between insurance firms by impact and response to climate change and relate the firms’ financial characteristics to climate risk exposure. A text mining approach using climate change sub-dictionaries on risk exposure, impact, and response, and a nested feature extraction method is developed to define and classify insurance firms’ adaptation levels to climate change. These features reveal that casualty insurance firms are most susceptible to acute climate risk, while life insurance firms are more prone to chronic climate risk. Insurance firms with the highest exposure to climate change present a high level of adaptation to pecuniary impact of the risk. Nevertheless, many firms with exposure remain inadequately prepared for climate change and firms with high exposure show relatively higher financial weakness.

Work in Progress

Attitudes in Finance (with Prof. William Goetzmann and Dr. Francesco Fabozzi)

Inside Hedge Funds: Evidence from Mandatory and Voluntary Disclosures (with Prof. Bing Liang)

Identifying Skilled Mutual Fund Managers through Mandatory Disclosures (with Prof. Asli Eksi)

Local Income Uncertainty and Peer-to-Peer Lending

Coauthered with Chen Li

Presentations: University of Massachussets Amherst

Draft available upon request

Detailed Highlight Results for Working Papers

Strategic ESG Sentiment Exposures in the Hedge Fund Industry

Detailed Highlight results

The figure above displays the monthly composite ESG sentiment index, constructed using 23 net sentiment variables across the environmental, social, and governance (ESG) pillars (Jan. 2003-Dec. 2024). Red solid boxes highlight major ESG milestones associated with peaks in sentiment, the black dashed box indicates periods of ESG-related scandals contributing to a decline in the index.

The figures above and below show Value-at-Risk analyses linking predicted increases in litigation and liquidation probabilities to cumulative AUM in the 2023 TASS-ADV matched live fund sample. The Figure above shows the predicted adverse liquidation probability against the accumulative AUM.

The figure above presents the predicted increase in litigation cases (indicator) against the cumulative AUM in the 2023 TASS-ADV matched live fund sample.

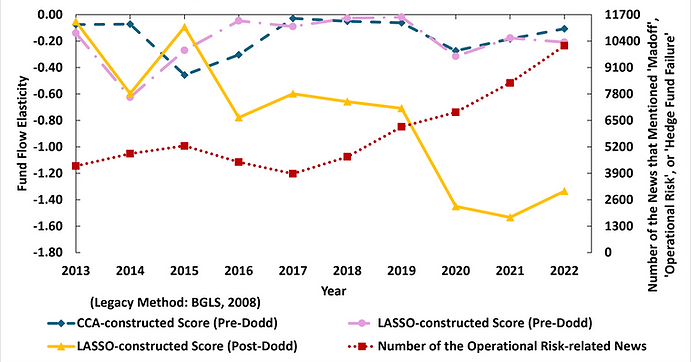

This figure presents out-of-sample cross-sectional predictions of SEC-registered fund flows using three operational risk scores: a CCA-based legacy model (using pre-Dodd-Frank variables) and two LASSO-based Ω-scores (constructed with either pre-Dodd or both pre- and post-Dodd-Frank variables). It also includes a trend of operational risk-related news attention (red dotted lines).

Media Coverage: Faculti (https://faculti.net/the-dodd-frank-act-and-hedge-fund-operational-risk/)

Uncovering the Hidden Profit: How the Fintech Platform Optimizes its Profit by Strategic Information Releasing?

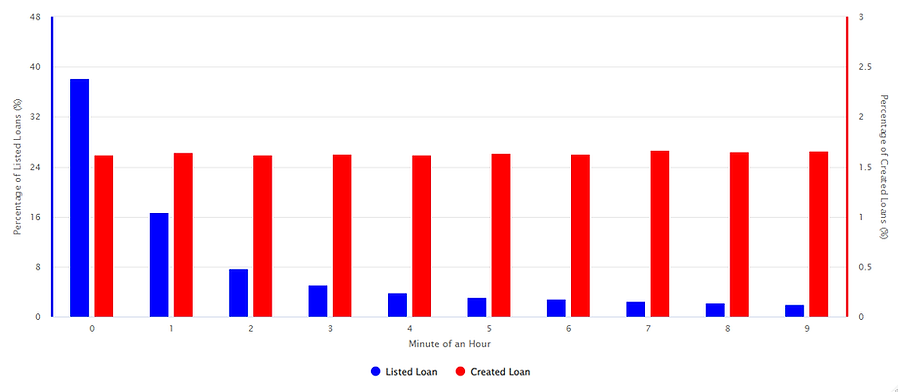

The figure above shows the percentage of loan creation times (red) and listing times (blue) across the first 10 minutes of the hour (0 on the x-axis means the first minute), using our full Prosper loan sample (November 2005–December 2021). The far left and far right ends of each bar correspond to the y-axes for creation and listing times, respectively.

This figure displays the Prosper fees during the first two minutes of an hour, where -60 to 0 represents the seconds in the first minute, and 0 to 60 represents the seconds in the second minute.

Assessing U.S. Insurance Firms' Climate Change Impact and Response

The figure above presents the structure of our climate change sub-dictionaries and their attributes. The overall climate change dictionary consists of three sub-dictionaries with additional categories under each sub-dictionary.

This figure presents our regression tree analysis of climate change risk exposure. Sub-figure (a) shows the decision tree for predicting acute risk. Sub-figure (b) shows the decision tree for predicting chronic risk and sub figure (c) for predicting the total risk, defined as the sum of acute and chronic risk words. Model training is done on 85% of the data and testing is done on the remaining 15%.All trees are pruned to reduce the root mean squared error.